Data Value > Data Risk

In our last issue, we explored how privacy programs support the data value chain. This time, we expand on that theme and show how to position privacy and governance as value curators, not just risk gatekeepers.

Boards and executives want more than assurance that data is compliant. They want to see how it drives performance. They aim to maximize the utility of data assets to create a competitive advantage. Privacy & data leaders must learn to speak in terms of value.

This doesn’t mean generating every metric yourself. It means knowing which measures matter, where to find them, and how to frame them in business terms. Governance teams are uniquely positioned to show how responsible data practices support growth.

The Data Value Equation

To lead with data, you need a clear way to talk about what makes it valuable. A simple framework can help:

Data Value = Revenue Impact + Cost Reduction + Risk Mitigation + Strategic Options

You don’t need to calculate these figures yourself, but you should understand the kinds of business outcomes they represent. Below are example categories and how they tie back to governance:

- Revenue Impact: Personalization increases customer lifetime value, but only when built on trust. For example, Netflix’s recommendation engine drives 80% of viewing.

- Conversion Rates: Ethical, transparent data use boosts funnel performance and reduces friction.

- New Revenue Streams: Clear boundaries and consent unlock monetization. Companies like John Deere generate billions by offering services built on responsibly governed data.

- Operational Efficiency: Good governance ensures reliable data, reducing errors and improving automation.

- Strategic Agility: High-quality, well-managed data supports a faster time to market and mort thoughtful and intelligent decisions.

The key is to connect these outcomes back to the role privacy and governance play in enabling them. That’s how you show value.

Rethinking Risk

Risk isn’t the enemy; unmanaged risk is. The absence of risk often means the absence of innovation. Governance should enable innovation, not block it. That starts with knowing what categories of risk matter most and how to frame them:

- Regulatory Exposure: Track the percentage of your data use that is compliant with laws across jurisdictions. A high regulatory readiness score means your innovation is less likely to be derailed by legal issues.

- Incident Preparedness: The average time to detect and contain incidents reflects your organization’s readiness. Great governance teams are proactive, mitigating risks before they grow.

- Privacy Review Coverage: Are privacy impact assessments being completed for new projects? A growing percentage shows quality and quantity improvements year over year.

- Operational Integrity: Low-quality data creates hidden operational risk. Track changes in data integrity, including external data sources and practices. A high data quality index is both a value and a risk metric.

- Trust and Transparency: Public perception matters. Tracking a customer trust score or transparency index helps monitor reputational exposure. Include employee sentiment about data handling for a 360 view.

These risk indicators don’t need to come solely from your team, but you should know how to interpret them and link them to your governance work.

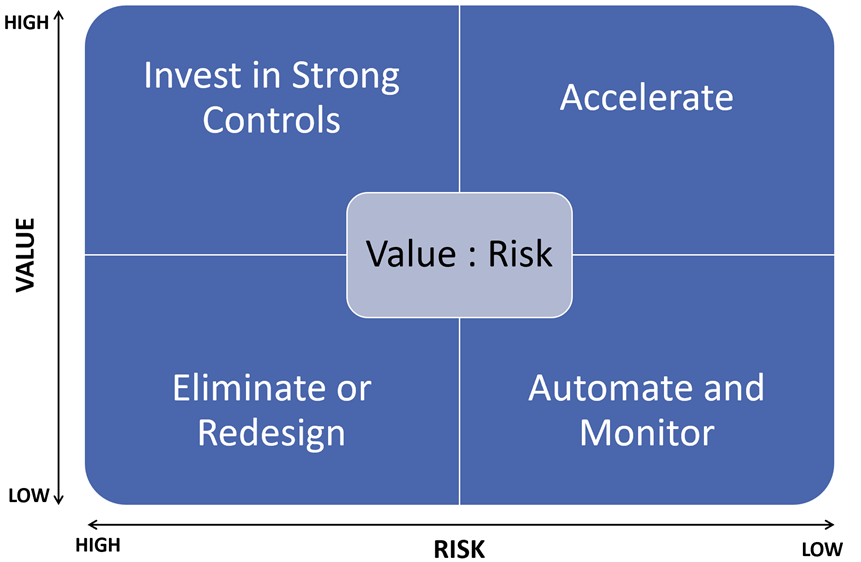

And when it comes to action, use a risk–value matrix as your guide:

Governance leaders help the business make smarter, safer bets, not avoid the betting table altogether.

Your Next Steps

Your new leadership role is to curate the right metrics and tell the story of how trusted data fuels business growth. Here’s how to get started:

- Pick your metrics. Choose one data value metric and one risk metric to surface right away.

- Frame the conversation. Use those numbers to shift privacy and governance from cost centers into strategic enablers.